- Make sure you have a current copy of Medicare-and-You. This handbook has details about what Medicare covers and provides website and phone numbers where you can get additional information.

- The number for Medicare is 1 800 633 4227 and they are opened 24 hours per day, seven days per week.

- During Open Enrollment, which is from October 15th through December 7th, you can change Medicare Advantage plans.

- Another change you can make during Open Enrollment is from a Medicare Advantage to a Medicare Supplement plan. According to page 23 of Choosing-A-Medigap, you have a one-year Trial right for Medicare Advantage plans. This means that during the first year, you can return to Original Medicare and enroll in a Medicare Supplement without going through medical underwriting. When an applicant is required to go through medical underwriting the insurance company can decline them or charge them a higher premium. According to page 22 of Choosing-A-Medigap, you can also enroll in a Medicare Supplement without medical underwriting if your Medicare Advantage policy is terminated. You can enroll in a Medicare Supplement as early as 60 days before your coverage ends, but no later than 63 days after your coverage ends. After your one-year Trial Right, most Medicare Supplement insurance companies will require you to go through medical underwriting unless your Medicare Advantage policy has been and will be terminated. BlueCross BlueShield is exception to this. They have the Blue-to-Blue Rule which allows their Medicare Advantage Policy holders to switch to one of their Medicare Supplements during Open Enrollment without medical underwriting.

- To ensure you pay the lowest amount for your prescription drugs make sure you use one of your plans preferred pharmacies or their preferred mail order.

- If your doctor recommends you take a new drug that is not in the formulary of your current Medicare Advantage plan, you can contact their customer service and request an exception. Also, you can shop around for the best price. Online applications like GoodRx.com and Singlecare.com often have coupons that offer significant savings. You may be able to get a lower cost through discounts at a local pharmacy, an on-line pharmacy like Mark Cuban’s pharmacy, Costplusdrugs.com or Marley Drugs (https://www.marleydrug.com, 1 866-997-2871). From this website: www.needymeds.org, people often find huge savings on expensive drugs. This organization helps them connect with the manufacturers of expensive drugs to obtain them at no cost or a low cost. Their number is 1 800-503-6897. Another option is to order your drug from a Canadian pharmacy like Canadian Prescriptions Plus (1-866-779-7587, www.canadianprescriptionsplus.com).

- If you are traveling outside of the United States, make sure your contact your Medicare Advantage insurance company to determine if your coverage will be sufficient. You may need to purchase travel insurance.

- Unlike Medicare Supplements, Medicare Advantage plans are regional. If you move out of your plan’s service area you will have a Special Election Period which begins 1 month before your move and 2 months after the move to enroll in a new plan. Read More

8 Facts Folks with Medicare Advantage Plans Should Know

Mar

2024Mar

2024Topics Covered and Questions Answered:

- Explanation of the ACA (Affordable Care Act) provisions

- ACA Terminology

- How to choose a plan?

- Who is eligible for a government subsidy?

- How to apply for a government subsidy and what questions to expect?

- When you can apply for health insurance that is compliant with the Affordable Care Act?

- What alternatives are available to ACA compliant policies?

- Who to call when you have health insurance complaints or to report fraud.

To be in compliance with the Affordable Care Act (a.k.a. ObamaCare) a health insurance policy much conform to the following provisions:

- Individuals cannot be declined for health insurance or charged more due to their health status or gender.

- Insurance premiums are based on age, your zip code and tobacco usage.

- Coverage limitations or exclusions based on pre-existing conditions are not allowed.

- Elimination of annual and lifetime coverage limits.

- Prohibition of declining an individual for coverage based on their participation in an approved clinical trial.

- Maternity and mental health are included on all policies.

- Whether or not your children are students they can stay on your policy until age 26.

- Introduction of the Medical Loss Ratio, which ensures that 80% of the premium dollars paid to the health insurance issuer are spent on providing health care. An insurance company that does not do this must provide rebates to their policyholders.

When can you apply for Health Insurance that is compliant with the ACA?

Whether or not you qualify for financial assistance paying your health insurance premiums, you can only apply during Open Enrollment, which is between November 1st and December 15th. The effective date for these policies is the following January 1st. Normally, the only exception is if you have a Qualifying Life Event that triggers a Special Election Period (SEP), which is normally 60 days. Examples of a Qualifying Life Event are getting married, birth or adoption of a child, permanently moving to a new area that offers different health plan options, losing health coverage due to job loss, divorce, loss of Medicaid or CHIP eligibility, expiration of COBRA, or a health plan being decertified. Note: Voluntarily dropping your health insurance or being terminated for not paying premiums is not a qualifying event.

What is a Marketplace Subsidy and who is eligible?

Individuals or families who are not eligible for employer health insurance and whose household income is between 100% and 400% of the Federal Poverty Level are usually eligible. Sometimes individuals who are offered health insurance from their employer are approved for a subsidy if their employer’s plan is not ACA compliant or the employer’s plan is not considered “affordable”. Since NC has not expanded Medicaid, you will probably not be eligible for government assistance if your income is below a certain level. Even if you do not qualify for Medicaid, your children may qualify for Medicaid or CHIP.

How your subsidy and health insurance premiums are determined?

The amount of a government subsidy is based on the age of each family member, family size, and your estimated Modified Adjusted Gross Income (MAGI) of the entire family for 2020. Normally this is income before state and federal taxes are subtracted.

Health insurance premiums are based on age of each family member, zip code, the plan design (i.e. size of deductible, co-pays and provider network), tobacco usage and the claims experience of the plan and insurance company. If you qualify for a subsidy you can take it as a tax credit when you file your taxes, take part of it or do as the majority of policy holders do, take the entire amount each month. Unless you choose to wait until you file your taxes, the government sends your subsidy to your insurance company each month and you pay the difference.

Due to the American Rescue Act, people with higher incomes are now eligible to receive a subsidy to pay for their health insurance. The goal is for nobody to pay more than 8 % of their income for health insurance.

Understanding Insurance and Affordable Care Act Terminology:

ACA-It stands for Affordable Care Act which went into effect January 1, 2014 and is also known as heath care reform, Patient Protection Affordable Care Act, PPACA or ObamaCare.

Broker– This is an insurance agent who represents multiple insurance companies. Agents and brokers who have completed and passed the CMS Marketplace training can assist individuals with enrolling in a Marketplace plan over the phone. Most, like me, have access to software which allows them to enroll their clients without meeting with them in person.

CHIP– An acronym for Children’s Health Insurance Program. This is administered by the state and provides no-cost or low-cost health insurance for children in families who earn too much to qualify for Medicaid, but cannot afford to purchase private insurance. In NC this is known as Health Choice. You can apply anytime.

CMS- An acronym for Centers for Medicare & Medicaid Services. This agency, which is under the U.S. Department of Health and Human Services, is responsible for Medicare, Medicaid and the implementation of the Affordable Care Act.

COBRA (Consolidated Omnibus Budget Reconciliation Act of 1985) allows workers and their dependents to purchase group coverage for 18 months (or sometimes longer) when the worker is voluntarily or involuntarily terminated. Workers can pay up to 102 % of the cost of the premium the employer pays for coverage. The former employee can purchase COBRA for a dependent even if he does not purchase it for himself. Also, normally one can accept the dental and vision COBRA even if they don’t accept the medical.

Deductible – The amount you or your family owe for certain covered medical procedures or services before your health insurance begins to pay.

Coinsurance – When you pay a percentage of the cost of a covered medical procedure or service after the deductible is met.

EHB- An acronym for the 10 Essential Health Benefits that the Affordable Care Act requires for all policies that are effective January 1, 2014 or later. These are ambulatory patient services, emergency services, maternity, pediatric dental & vision, rehabilitative services & devices, mental health & substance use disorder, preventive (including chronic disease management), hospitalization, prescription drugs and laboratory services.

Health Insurance Marketplace– An online marketplace where individuals can compare, shop for and buy qualified health insurance plans. It is also called the “Exchange” or healthcare.gov. A policy purchased through the Marketplace is called an “On-Exchange” policy. One purchased directly from the insurance company is called an “Off-Exchange” policy.

IRS Qualified High Deductible Health Plans (HSA Plans) – With this health insurance plan the policy holder pays for all medical expenses except preventative until he reaches his deductible. These plans can be paired with a Health Savings Account (HSA) which can reduce the policy holder’s taxable income. The policy holder can withdraw money from his Health Savings Account to pay his medical expenses without a penalty. Individuals who purchase these plans are not required to set up an HSA. My website, www.hisonc.com, has more details about Health Savings Accounts.

Maximum out of pocket limit – This is the maximum a policy holder has to pay from their own funds for covered medical procedures during the calendar year. This includes the amount spent on deductibles. copayments, coinsurance and prescription drugs. It does not include the amount spent on premiums, non covered services and out of medical network charges.

Medicaid- A program run jointly by the Federal and State Governments that provides health coverage for low-income people, families, children, the elderly and people with disabilities. You can apply anytime. To apply for Medicaid or CHIP call 919-212-7000 or visit https://dma.ncdhhs.gov/medicaid. Since North Carolina expanded Medicaid effective December 1st, 2023, many low income people will now receive Medicaid instead of receiving a subsidized policy.

Navigators– Individuals who have completed the CMS training so they can assist consumers with applying for Marketplace Plans. They also provide outreach and education to raise awareness about the Marketplace Plans. Their activities and pay are funded through state and federal grant programs. To find the location of a navigator or set up an appointment, call 1-855-733-3711 or visit NCNavigator.net.

QHP– An acronym for Qualified Health Plan which is a health plan that has the 10 essential benefits.

Short Term Medical Policies (STM) – As the name implies, these are health insurance policies for individuals who need coverage for a short period. Although some will provide coverage for up to 12 months and can be renewed for several years, they normally do not cover any pre-existing conditions or preventive. Due to the fact that consumers can now purchase these plans for longer periods they sometimes assume they will cover preventative and are surprised when they discover they much pay out of pocket for their preventative exam.

Step Therapy- Policy holders taking an expensive brand drug are often required by their insurance company to try a generic equivalent. If your doctor thinks this would be a threat to your health he can request an exception from your insurance company.

Metallic levels of the Health Insurance Plans

Health care reform established these levels to help consumers compare the value of various plans. They are used for plans on and off the exchange.

Bronze- Ideal for people that want low premiums and don’t expect to need a lot of medical services. Policies that are compatible with Health Savings Accounts are in this category.

Silver– Designed for those who want monthly premiums and out-of-pocket medical costs more balanced. Applicants with very low incomes are eligible for silver enhanced plans with lower copays, deductibles and maximum out of pockets.

Gold– These plans are designed for individuals who receive medical attention on a regular basis and are willing to pay a higher premium.

Catastrophic– These are the least expensive plans designed for individual who rarely have any medical expenses. Unless you have a “hardship” exemption you must be under age 30 to qualify for this plan. To get a “hardship” exemption you must submit an application, which is on the Marketplace web site, and be approved. Examples of hardships that would qualify you for the exemption are being homeless, an eviction from your home during the past 6 months, recent shut-off from a utility company, domestic violence, damage to your property due to natural or human caused disaster, bankruptcy, death of a close family member or having an income too low to qualify for government financial assistance for health insurance. If you choose this policy you will not be eligible for a subsidy.

These are the insurance companies that in 2022 will offer insurance plans compliant with the Affordable Care Act in NC:

BlueCross BlueShield of North Carolina, a.k.a BCBSNC (www.bcbsnc.com)

For residents of Alamance, Caswell, Chatham, Durham, Franklin, Johnston, Lee, Orange Person and Wake Counties the medical provider network is Blue Home with UNC. Blue Home’s network is UNC Health Alliance (which includes Rex Hospital) and its affiliated doctors and hospitals.

BCBSNC offers policies compliant with the (ACA)Affordable Care Act in all counties. However, the medical networks vary by county.

Aetna CVS Health Insurance (www.aetnacvshealth.com): Aetna offers HMO (Health Maintenance organization)plans compliant with the ACA in 70 counties. Their plans are offered in the Asheville, Charlotte, Fayetteville, Triad and Triangle area. These plans do not require a referral to see a specialist. In network hospitals include Atrium Health, CaroMont Health, Mission Health, Cone, Baptist Hospital, Duke Health, WakeMed Hospital, Cape Fear Valley Health and Vidant.

Ambetter Health Insurance (www.ambetterofnorthcarolina.com, created from Celtic Insurance in 2014, Parent company is Centene) offers HMO (Health Maintenance Organization) plans in Alamance, Alexander, Allegany, Bladen, Caswell, Cumberland, Chatham, Davidson, Davie, Durham, Forsythe, Franklin, Granville, Guilford, Harnett, Hoke, Iredell, Johnston, Lee, Montgomery, Moore, Orange, Person, Randolph, Richmond, Robesson, Rockingham, Sampson, Scotland, Stokes, Vance, Wake, Warren, Wilkes and Yadkin Counties. This means if you go to an out of network provider the insurance company will not pay for your medical services unless it is coded as an emergency. Ambetter does not require you have a referral from your PCP (Primary Care Physician) before you visit a specialist. Baptist, First Health Moore Regional, Duke, Moses Cone and WakeMed hospitals are in-network with Ambetter.

Their plans include:

- Myhealthpays Rewards which allows policyholders to earn up to $500 for health activities like getting a flu shot, having a wellness exam and completing an Ambetter Wellness survey. The rewards are given in the form of a prepaid Visa card and can be used to pay premiums, co-pays or buy over the counter items at some retail stores.

- Telehealth, which is a 24 hour phone or video access to in-network providers for non-emergency health issues.

- Some plans include dental and vision for adults.

Amerihealth Caritas: Amerihealth Caritas offers HMO (Health Maintenance Organization) policies Alexander, Alleghany, Ashe, Avery, Buncombe, Burke, Caldwell, Catawba, Cherokee, Clay, Davidson, Davie, Forsyth, Graham, Guilford, Haywood, Henderson, Iredell, Jackson, Macon, Madison, McDowell, Mitchell, Polk, Randoph, Rockingham, Rutherford, Stockes, Surry, Swain, Transylvania, Watauga, Wilkes, Yadkin and Yancey counties.

Wake Forest Baptist, Mission, Duke LifePoint and Iredell hospitals are in network with Amerihealth. Amerihealth offers extra benefits like a Health Rewards Card and free Weight Watcher memberships.

Cigna: Cigna offers HMO (Health Maintenance Organization): Cigna offers HMO plans in the Raleigh/Durham area in Alamance, Durham, Franklin, Granville, Johnston, Lee, Orange, Person, Vance,Warren and Wake counties. With their rural expansion they also offer plans in Montegumery, Moore, Richmond, Scotland, Hoke, Robeson, Cumberland, Harnett, Bladen, Sampson, Duplin, Onslow, Wayne, Greene, Wilson, Pitt, Edgecomb, Nash, Halifax, Northamption, Hertford, Gates, Chowan, Perquimans, Pasquotank, Camden, Currituck, Bertie, Martin, Cateret. Jones, Pamilico, Craven, Lenoir, Beaufort, Hyde, Dare, Tyrell, Washington, Cherokee, Graham, Clay, Macon, Swain, Jackson, Translyvania, Haywood, Madison, Buncombe, Henderson, Polk, Rutherford, McDowell, Yancey Mitchell, and Avery.

In network hospitals include Advent Health,Betsy Johnson, Bladen County, Cape Fear Valley, Central Harnett, Duke, First Health Regional, Highsmith Rainey,Sampson Regional, Southeastern Regional, Vidant, WakeMed and Wilson Regional.

Their HMO plans require the policy holder to have a PCP (Primary Care Physician). Unless it’s an emergency these plans do not pay your medical expenses if you go outside their medical provider network. Also, they will not pay for specialist visits if you do not have a referral from your PCP.

Oscar Health Insurance: offers HMO policies in the Asheville area. Their service area includes Buncombe, Haywood, Henderson, Madison, Transylvania, Macon, McDowell, Jackson, Polk and Yancey counties. In network hospitals include Mission, Angel, Highlands-Cashiers and Transylvania. Referrals are not required to visit a specialist, but some specials may require a referral from a PCP.

Their plans include:

- 24/7 Virtual Urgent Care for $0 a visit

- Get paid to Walk where you can earn up to $100 per year Amazon Gift Card

United Healthcare: offer HMO policies in the following counties Alexander, Bladen, Brunswick, Buncombe, Burke, Caldwell, Columbus, Cumberland, Durham, Franklin, Guilford, Harnett, Haywood,Henderson, Hoke, Iredell, Jackson, Johnston, McDowell, New Hanover, Orange,Pender, Randolph, Richamond, Robeson, Rutherford, Sampson, Scottland, Transyvania and Wake Counties. These plans do require you to obtain a referral from your Primary Care Physician before you visit a specialist.

In network hospitals include Advent Health Hendersonville, Angel Medical, Annie Penn, Betsy Johnson,DLP Rutherford Regional, Haywood Regional Memorial, Harris Regional, Highlands Cashiers, Highpoint Regional, Johnston Memorial,Margaret R.Pardee Memorial, MH Mission, Moses Cone, Randolph Health, Rex, Translyvania Regional and UNC.

These are examples of questions to ask before you enroll in a new plan:

- Are my medical providers (i.e. doctors, pharmacies and hospitals) in the network of this plan?

- If I see a medical provider out of network when it’s not emergency will I have to pay the full cost myself?

- What is the deductible (dollar amount you must pay before your insurance pays) for medical procedures and pharmaceuticals?

- Are my prescription drugs in the formulary of this plan?

- What are the co-pays (fixed dollar amount) for medical services and my prescription drugs?

- Is a referral required from my Primary Care Provider to visit a Specialist?

- What is the Maximum out of pocket? This is the maximum you pay from your own funds and includes deductibles, co-pays and co-insurance for covered medical and drug expenses. Once you reach this amount the insurance must pay 100% of your medical expenses until the end of the year.

- Is this plan compliant with the ACA (Affordable Care Act)?

Required information and documents when you are applying for a subsidy:

- You must provide dates of birth and social security numbers of all the members of your household.

- You’re required to provide all sources of income. For example, if you work for a company but also have rental income or dividend producing stock, you must provide information and dollar amounts about each type of income. If you are self-employed you must provide information about your type of work, expected income as well as name and address of your company.

- Child support, Veteran’s payments and Supplemental Security Income are not considered part of your income.

- Income information must be provided for everyone you claim or claims you on your 1040 tax form even if they are not applying for coverage.

- Normally your children’s income is included as part of your income if you claim them as a dependent on your income tax return.

- If you are not a US Citizen you will be required to provide your immigration documentation.

- You will be asked if you plan to file an income tax return in 2021. If you say no you will be told that you are not eligible for a subsidy.

- Once you are approved for a Marketplace subsidy you may be asked to provide proof of income or other information. They will give you an exact date that they must receive this information. If you don’t have this information to them by the specified date they will terminate your subsidy.

- If you receive help from an agent or broker, CMS (Centers for Medicare and Medicaid) will request that the broker have you initial and sign a CMS Consent form. This for your protection and ensures the agent or broker has your permission to assist them with an application that requires personal information.

How do you apply?

You can do it yourself on-line at www.healthcare.gov or by calling for assistance at 800-318-2596. However, these are professionals who can assist you at no cost:

- Although there are exceptions, most health insurance brokers and agents do not charge for their services. These services include explaining your policy choices so you can make an informed decision. Our access to Health Sherpa software means you do not have to meet with us in person or log into the Marketplace. After you are enrolled in a policy we continue to be available to answers your questions and address your concerns.

- You can meet with a navigator in person. Go to NCNavigator.net to find a planned public navigator event in your area or make an appointment. You can also call 1-855-733-3711.

Once you have been approved for a subsidy and selected your health insurance plan from the Marketplace, your information will be transmitted electronically to your insurance company. If you have a broker or agent they receive a report which allows them to follow your application through the enrollment process making sure you make your first payment on time, supply the Marketplace with additional information if they request it and make the process as problem free as possible.

What alternatives do you have to purchasing an individual ACA health insurance policy?

Short Term Medical plans

Association Medical plans through organizations

COBRA

Small Group Plans

Health Sharing Ministries (not health insurance)

Tricare

Veteran’s benefits

Wanda Stephens, NPN (National Producer Number): 8504772

Health Insurance Solutions of NC Website: www.hisonc.com

Email: wanda@hisonc.com Office: 919 845 6001 Cell: 919 740 653

Mar

2024Enrolling in Medicare Part B – whether you are just turning 65 or have worked past 65

If you are self-employed or retired when you turn 65, signing up for Medicare Part B is a very simple process. You simply go to the Social Security website, www.ssa.gov, and do it on-line. Medicare allows you to enroll in Part B the 3 months before your birthday, the month of your birthday and 3 months after your birthday. This time period is called your Initial Enrollment Period. To ensure they have their Medicare cards as soon as possible, I encourage my clients to go on-line to enroll in Part B during the month they are first eligible to apply. Individuals who receive their Social Security checks before 65 are automatically enrolled in Medicare Part B.

Unless in 2022 your Modified Adjusted Gross Income was higher than $103,000 as a single person or $206,000 as a married couple, you will pay $174.70 per month for Part B. If your income is higher than these amounts you will pay more. Unless you are fortunate enough to have worked for a company or government agency which provides lifetime health benefits, your choices are either a Medicare Advantage plan with drug coverage or a Medicare Supplement and drug plan. Either choice is protection against unlimited medical expenses. To enroll in a Medicare Supplement or Advantage plan you are required to be enrolled in both Medicare Part A and B.

Often people work past 65 (or have a spouse who is working) for a company with 20 or more employees that provides them with health insurance without enrolling in Part B. When these benefits are lost due to retirement, death of a spouse, divorce or layoff, signing up for Part B is more complicated if you are past the Initial Enrollment Period. Any of these scenarios are considered a SEP (Special Election Period). In this type of SEP one must fill out a paper application for Medicare Part B, and Section A of the Request for Employment Information form. Your (or your spouse’s) employer must complete Section B of this form. The Request of Employment Information form Section B is needed to confirm you have had credible health insurance coverage during your employment. This is an important part of the process which will prevent you from being penalized for not enrolling in Part B when you first turned 65.

These forms can be found at your nearest Social Security office or going to their website, www.ssa.gov. Once completed they should be mailed or hand carried to the nearest Social Security office. For additional information contact Social Security at 1-800-772-1213.

Mar

2024All Medicare beneficiaries must be enrolled in both Medicare Part A and B before they are allowed to enroll in a Medicare Supplement or Advantage policy. The standard Part B premium amount in 2024 is $174.70. Most people pay the standard Part B premium amount. If your Modified Adjusted Gross Income (MAGI) as reported on your IRS tax return from 2 years ago is above a certain amount, you’ll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium. The chart below shows what you can expect to pay for Medicare Part B.

Find out if you’ll pay a higher Part B premium in 2024:

| As this chart show, your 2022 MAGI determines if your Part B premium will be more than the standard amount: | You pay each month (in 2024) | ||

|---|---|---|---|

| File individual tax return | File joint tax return | File married & separate tax return | |

| $103,000 or less | $206,000 or less | $103,000 or less | $174.70 |

| above $103,000 up to $129,000 | above $206,000 up to $258,000 | Not applicable | $244.60 |

| above $129,000 up to $161,000 | above $258,000 up to $322,000 | Not applicable | $349.40 |

| above $161,000 up to $193,000 | above $322,000 up to $386,000 | Not applicable | $454.20 |

| above $193,000 and less than $500,000 | above $386,000 and less than $750,000 | above $103,000 and less than $397,000 | $559.00 |

| $500,000 or above | $750,000 or above | $397,000 or above | $594.00 |

As this chart shows, if you pay more for Medicare Part B, you will also pay more for your Medicare drug plan:

2024

As this chart shows, if you pay more than the standard amount for Medicare Part B, you will pay more for your drug plan:

| File individual tax return | File joint tax return | File married & separate tax return | You pay each month (in 2024) |

|---|---|---|---|

| $103,000 or less | $206,000 or less | $103,000 or less | your plan premium |

| above $103,000 up to $129,000 | above $206,000 up to $258,000 | not applicable | $12.90 + your plan premium |

| above $129,000 up to $161,000 | above $258,000 up to $322,000 | not applicable | $33.30 + your plan premium |

| above $161,000 up to $193,000 | above $322,000 up to $386,000 | not applicable | $53.80 + your plan premium |

| above $193,000 and less than $500,000 | above $386,000 and less than $750,000 | above $103,000 and less than $397,000 | $74.20 + your plan premium |

| $500,000 or above | $750,000 or above | $397,000 or above | $81.00 + your plan premium |

If you find that your past income will cause you to pay more for both Medicare Part B and your drug plan, but expect your income to be much lower after retirement, you can contact Social Security at 1 800 408 1212 and appeal these additional premiums. Social Security is opened Monday through Friday from 7 AM until 7 PM.

Feb

2024Baby Boomers turning 65 in North Carolina have an abundance of choices with regard to their Medicare insurance. My customers who have been buying their own health insurance and don’t qualify for a government subsidy are thrilled to be able to choose from many policies that are much more affordable. Their challenge is sorting through these numerous policies and choosing what is right for their lifestyle, health needs and pocketbook. If you are uncertain which plan or plans are best for you, here is a step by step guide to ensure you make a wise decision: Read More

Feb

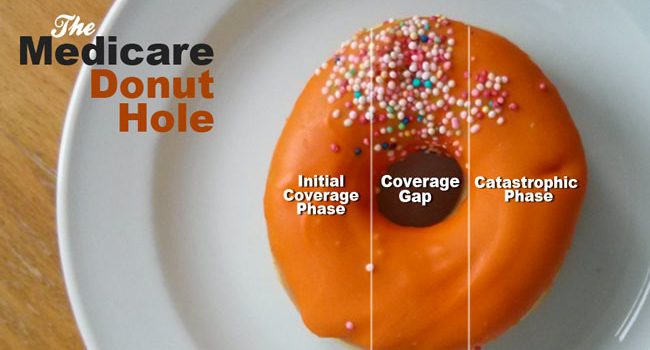

2024If you’re turning 65 or becoming Medicare eligible one of your challenges is choosing a drug plan. Many are confused by the term “Donut Hole” (also called the Coverage Gap). Medicare Prescription Drug Plans have four parts or phases, Initial Deductible, Initial Coverage, Donut Hole and Catastrophic. To understand the Donut Hole it’s important to understand each of these parts.

- The drug plan you choose for 2024 might have no deductible or a deductible as high as $545. Many drug plans have no deductible on the inexpensive generic drugs, but have deductibles on the more expensive brand drugs. This is one way the insurance companies that market these plans control their costs and encourage their members to use generic drugs whenever possible.

- After the initial deductible (if there is one) is met you enter the Initial Coverage Phase. During this period you only pay a copay or a percentage of your prescription drugs. If you purchase a drug with a retail value of $100, but pay $30, the entire $100 counts toward your Initial Coverage Limit. When the retail amount you are paying for all your drugs reaches $5,030(your Initial Coverage Limit for 2024) you have entered the Donut Hole Phase. Another way to say this is when what both you and your Part D Insurance Plan are paying for your drugs reaches $5,030 you’re in the Donut Hole.

- While in the Donut Hole you will pay 25% for your brand-name drugs and generic drugs. When the total amount that you and your Part D Insurance plan reaches $8,000 you will exit the Donut Hole and enter the Catastrophic Phase.

- During the Catastrophic Phase you will pay nothing for your prescription drugs for the rest of the plan year.

Jan

20241.Make sure you have a current copy of Medicare & You. This handbook has details about what Medicare covers and provides websites and phone numbers where you can get additional information.

2.Remember that if Medicare does not pay for a medical procedure your Medicare Supplement will not pay for their share. If you are uncertain if a procedure is covered, you might find the answer in Medicare & You. You can also call Medicare at 1 800 633 4227 and they are opened 24 hours per day, seven days per week.

3.During Open Enrollment, which is from October 15th through December 7th, you can change Medicare drug plans. Also during this period you can change from a Medicare Supplement to a Medicare Advantage plan. Unless you have creditable drug coverage from a previous employers or the VA, do not drop your Medicare Drug Policy without enrolling in a new one. Medicare Beneficiaries who have gaps in coverage normally pay a penalty when they enroll in a Medicare Drug plan in the future.

4. Medicare Prescription Drug plans often make changes to their formularies, deductibles, preferred pharmacies and other features from year to year. Also, often Medicare beneficiaries have changes in their medications. It is in your best interest to register on http://www.medicare.gov and store your prescription drugs as well as preferred pharmacies on their site. This will allow you to quickly check during Open Enrollment to see if you need to change to a different Medicare Prescription Drug plan.

5. If your doctor recommends you take a new drug that is not in the formulary of your current Medicare drug plan, you can contact their customer service and request an exception. Also, you can shop around for the best price. Online applications like GoodRx.com and Singlecare.com often have coupons that offer significant savings. You may be able to get a lower cost through discounts at a local pharmacy, an on-line pharmacy like Mark Cuban’s pharmacy, Costplusdrugs.com or Marley Drugs (https://www.marleydrug.com, 1 866-997-2871). From this website: www.needymeds.org, people often find huge savings on expensive drugs. This organization helps them connect with the manufacturers of expensive drugs to obtain them at no cost or a low cost. Their number is 1 800-503-6897. Another option is to order your drug from a Canadian pharmacy like Canadian Prescriptions Plus (1-866-779-7587, www.canadianprescriptionsplus.com).

6.You can apply for a different Medicare Supplement at another insurance company any time of the year. Medicare beneficiaries sometimes do this when they find a company with a much lower premium. However, unless you have a guarantee issue because your current plan is being cancelled, you will have to go through medical underwriting. This means the insurance company will ask you medical questions, review your medical records and can decline you.

7. Even if you are enrolled in a Medicare Supplement that provides coverage in a foreign coverage, the coverage is limited and is not the same coverage that you have in the United States. Also, your Medicare Supplement will not pay its share until Medicare pays. Since a hospital in a foreign country is unlikely to file claim with Medicare, you may be required to pay your medical expenses and file a claim for reimbursement when you return home. It may be in your best interest to purchase trip insurance.

Apr

2023Be aware of these requirements and procedures to avoid losing your government subsidy or paying back a huge amount when you file your tax returns:

- Often the method to make your first insurance payment (called the binder payment) for a Marketplace policy is different from the subsequent payments. This means you will receive an invoice every month unless you contact your insurance company and arrange for an automatic draft from your checking account, savings account, credit card or debit card. I’ve had several customers ignore invoices thinking they were on automatic bank draft when it had not been set up. Unfortunately, some did not realize the problem until they lost their insurance policy and could not re-apply again until Open Enrollment.

- Make sure you register on the website of your health insurance company. Although you will have a customer service number, this will give you a chance to view your claims, payment history and find information without making a phone call. Also, sometimes these sites offer discount coupons.

- Read your Marketplace Letter carefully. The Marketplace sometimes requires you to provide additional information several weeks after your policy begins. The type of information can be proof of your income, citizenship, identity or proof that you are in the U.S. legally. Even if you are paying your insurance premiums on time, the Marketplace will stop your government subsidy if you do not comply with their requests. This information can be uploaded to their website or mailed. If you mail it, make sure you follow their guidelines and include the barcode in Marketplace letter. Normally your insurance agent can upload your documents on your behalf.

- When you apply for a government subsidy you provide an estimate of your Modified Adjusted Gross Income (MAGI). Your subsidy is based on your MAGI, age, zip code and household members. Every January the Marketplace will mail 1095 A forms to heads of households receiving a subsidy. The information on the 1095 A is used to complete the 8962 form, which is used to reconcile the estimated income that you provided to the Marketplace with your actual income. If you don’t receive the 1095 A form, you can retrieve it at Healthcare.gov, call the Marketplace at 1 800 318 2596 or contact your agent. Even if you are only on a Marketplace policy for a short period you are required to complete this form. Failure to do this can prevent you from obtaining a subsidy in the future.

- If you have a change in circumstances such as a new job where you make a higher income or are offered health insurance, make sure you contact the Marketplace. A higher income needs to be reported because your new income could cause you to lose all or part of your subsidy. If your new job offers health insurance that is compliant with the Affordable Care Act, you are not allowed to receive subsidy unless your premium is more than 9.12 % of your Modified Adjusted Gross Income. Failure to comply with this policy could cause you to pay an IRS penalty.

- Do not call your health insurance company to cancel your health insurance policy. Instead call the Marketplace at 1 800 318 2596. Once the Marketplace receives your request, they will contact your insurance company and cancel your policy.

- Changes such as your marriage status, dependents, a member becoming eligible for Medicare or address should be reported to the Marketplace immediately since these changes can affect the amount of your subsidy, policies available and your premium.

.

- If you plan a trip outside of the United States, make sure your policy will provide the medical coverage you need. You may need to purchase Medical Trip Insurance.

Apr

2022If you have recently moved to the Raleigh Durham area and need assistance finding a Duke primary care or specialist doctor, the Duke Consultation and Referral Center can help. They are open Monday through Friday from 8:00 AM until 5 PM. Whether you or not they are Medicare eligible, my clients have found this number helpful. The Duke Referral Center has also help my customers whose doctors have retired or move to a new area find a new doctor.

Call 1-888-ASK-Duke (275-3853) to request an appointment or visit them on-line at dukehealth.org.

Mar

2020Unfortunately, BlueCross BlueShield of North Carolina (BCBSNC) no longer offers discounts on fertility services through a partnership with WINFertility.