Be aware of these requirements and procedures to avoid losing your government subsidy or paying back a huge amount when you file your tax returns: Often the method to make your first insurance payment (called the binder payment) for a Marketplace policy is different from the subsequent payments. This means

Monthly Archives:July 2018

Jul

2024Apr

2024Make sure you have a current copy of Medicare-and-You. This handbook has details about what Medicare covers and provides website and phone numbers where you can get additional information. The number for Medicare is 1 800 633 4227 and they are opened 24 hours per day, seven days per week. During

Apr

20241.Make sure you have a current copy of Medicare & You. This handbook has details about what Medicare covers and provides websites and phone numbers where you can get additional information. 2.Remember that if Medicare does not pay for a medical procedure your Medicare Supplement will not pay for their

Mar

2024Topics Covered and Questions Answered: Explanation of the ACA (Affordable Care Act) provisions ACA Terminology How to choose a plan? Who is eligible for a government subsidy? How to apply for a government subsidy and what questions to expect? When you can apply for health insurance that is compliant with

Mar

2024Enrolling in Medicare Part B – whether you are just turning 65 or have worked past 65 If you are self-employed or retired when you turn 65, signing up for Medicare Part B is a very simple process. You simply go to the Social Security website, www.ssa.gov, and do it on-line.

Mar

2024All Medicare beneficiaries must be enrolled in both Medicare Part A and B before they are allowed to enroll in a Medicare Supplement or Advantage policy. The standard Part B premium amount in 2024 is $174.70. Most people pay the standard Part B premium amount. If your Modified Adjusted Gross Income

Feb

2024Baby Boomers turning 65 in North Carolina have an abundance of choices with regard to their Medicare insurance. My customers who have been buying their own health insurance and don’t qualify for a government subsidy are thrilled to be able to choose from many policies that are much more affordable.

Feb

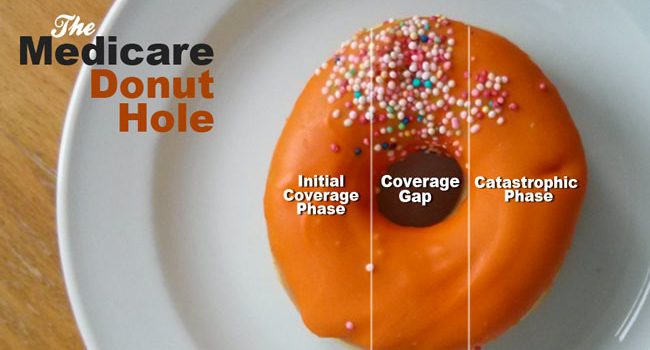

2024If you’re turning 65 or becoming Medicare eligible one of your challenges is choosing a drug plan. Many are confused by the term “Donut Hole” (also called the Coverage Gap). Medicare Prescription Drug Plans have four parts or phases, Initial Deductible, Initial Coverage, Donut Hole and Catastrophic. To understand the Donut

Apr

2022If you have recently moved to the Raleigh Durham area and need assistance finding a Duke primary care or specialist doctor, the Duke Consultation and Referral Center can help. They are open Monday through Friday from 8:00 AM until 5 PM. Whether you or not they are Medicare eligible, my

Mar

2020Unfortunately, BlueCross BlueShield of North Carolina (BCBSNC) no longer offers discounts on fertility services through a partnership with WINFertility.