- Make sure you have a current copy of Medicare-and-You. This handbook has details about what Medicare covers and provides website and phone numbers where you can get additional information.

- The number for Medicare is 1 800 633 4227 and they are opened 24 hours per day, seven days per week.

- During Open Enrollment, which is from October 15th through December 7th, you can change Medicare Advantage plans.

- Another change you can make during Open Enrollment is from a Medicare Advantage to a Medicare Supplement plan. According to page 23 of Choosing-A-Medigap, you have a one-year Trial right for Medicare Advantage plans. This means that during the first year, you can return to Original Medicare and enroll in a Medicare Supplement without going through medical underwriting. When an applicant is required to go through medical underwriting the insurance company can decline them or charge them a higher premium. According to page 22 of Choosing-A-Medigap, you can also enroll in a Medicare Supplement without medical underwriting if your Medicare Advantage policy is terminated. You can enroll in a Medicare Supplement as early as 60 days before your coverage ends, but no later than 63 days after your coverage ends. After your one-year Trial Right, most Medicare Supplement insurance companies will require you to go through medical underwriting unless your Medicare Advantage policy has been and will be terminated. BlueCross BlueShield is exception to this. They have the Blue-to-Blue Rule which allows their Medicare Advantage Policy holders to switch to one of their Medicare Supplements during Open Enrollment without medical underwriting.

- To ensure you pay the lowest amount for your prescription drugs make sure you use one of your plans preferred pharmacies or their preferred mail order.

- If your doctor recommends you take a new drug that is not in the formulary of your current Medicare Advantage plan, you can contact their customer service and request an exception. Also, you can shop around for the best price. Online applications like Blink.com, GoodRx.com and Singlecare.com often have coupons that offer significant savings. You may be able to get a lower cost through discounts at a local pharmacy, an on-line pharmacy like Amazon Pharmacy, Mark Cuban’s pharmacy, Costplusdrugs.com or Marley Drugs (https://www.marleydrug.com, 1 866-997-2871). From this website: www.needymeds.org, people often find huge savings on expensive drugs. This organization helps them connect with the manufacturers of expensive drugs to obtain them at no cost or a low cost. Their number is 1 800-503-6897. Another option is to order your drug from a Canadian pharmacy like Canadian Prescriptions Plus (1-866-779-7587, www.canadianprescriptionsplus.com).

- If you are traveling outside of the United States, make sure your contact your Medicare Advantage insurance company to determine if your coverage will be sufficient. You may need to purchase travel insurance.

- Unlike Medicare Supplements, Medicare Advantage plans are regional. If you move out of your plan’s service area you will have a Special Election Period which begins 1 month before your move and 2 months after the move to enroll in a new plan. Read More

Medicare

Apr

2024Apr

20241.Make sure you have a current copy of Medicare & You. This handbook has details about what Medicare covers and provides websites and phone numbers where you can get additional information.

2.Remember that if Medicare does not pay for a medical procedure your Medicare Supplement will not pay for their share. If you are uncertain if a procedure is covered, you might find the answer in Medicare & You. You can also call Medicare at 1 800 633 4227 and they are opened 24 hours per day, seven days per week.

3.During Open Enrollment, which is from October 15th through December 7th, you can change Medicare drug plans. Also during this period you can change from a Medicare Supplement to a Medicare Advantage plan. Unless you have creditable drug coverage from a previous employers or the VA, do not drop your Medicare Drug Policy without enrolling in a new one. Medicare Beneficiaries who have gaps in coverage normally pay a penalty when they enroll in a Medicare Drug plan in the future.

4. Medicare Prescription Drug plans often make changes to their formularies, deductibles, preferred pharmacies and other features from year to year. Also, often Medicare beneficiaries have changes in their medications. It is in your best interest to register on http://www.medicare.gov and store your prescription drugs as well as preferred pharmacies on their site. This will allow you to quickly check during Open Enrollment to see if you need to change to a different Medicare Prescription Drug plan.

5. If your doctor recommends you take a new drug that is not in the formulary of your current Medicare drug plan, you can contact their customer service and request an exception. Also, you can shop around for the best price. Online applications like Blink.com, GoodRx.com and Singlecare.com often have coupons that offer significant savings. You may be able to get a lower cost through discounts at a local pharmacy, an on-line pharmacy like Amazon Pharmacy, Mark Cuban’s pharmacy, Costplusdrugs.com or Marley Drugs (https://www.marleydrug.com, 1 866-997-2871). From this website: www.needymeds.org, people often find huge savings on expensive drugs. This organization helps them connect with the manufacturers of expensive drugs to obtain them at no cost or a low cost. Their number is 1 800-503-6897. Another option is to order your drug from a Canadian pharmacy like Canadian Prescriptions Plus (1-866-779-7587, www.canadianprescriptionsplus.com).

6.You can apply for a different Medicare Supplement at another insurance company any time of the year. Medicare beneficiaries sometimes do this when they find a company with a much lower premium. However, unless you have a guarantee issue because your current plan is being cancelled, you will have to go through medical underwriting. This means the insurance company will ask you medical questions, review your medical records and can decline you.

7. Even if you are enrolled in a Medicare Supplement that provides coverage in a foreign coverage, the coverage is limited and is not the same coverage that you have in the United States. Also, your Medicare Supplement will not pay its share until Medicare pays. Since a hospital in a foreign country is unlikely to file claim with Medicare, you may be required to pay your medical expenses and file a claim for reimbursement when you return home. It may be in your best interest to purchase trip insurance.

Mar

2024Enrolling in Medicare Part B – whether you are just turning 65 or have worked past 65

If you are self-employed or retired when you turn 65, signing up for Medicare Part B is a very simple process. You simply go to the Social Security website, www.ssa.gov, and do it on-line. Medicare allows you to enroll in Part B the 3 months before your birthday, the month of your birthday and 3 months after your birthday. This time period is called your Initial Enrollment Period. To ensure they have their Medicare cards as soon as possible, I encourage my clients to go on-line to enroll in Part B during the month they are first eligible to apply. Individuals who receive their Social Security checks before 65 are automatically enrolled in Medicare Part B.

Unless in 2022 your Modified Adjusted Gross Income was higher than $103,000 as a single person or $206,000 as a married couple, you will pay $174.70 per month for Part B. If your income is higher than these amounts you will pay more. Unless you are fortunate enough to have worked for a company or government agency which provides lifetime health benefits, your choices are either a Medicare Advantage plan with drug coverage or a Medicare Supplement and drug plan. Either choice is protection against unlimited medical expenses. To enroll in a Medicare Supplement or Advantage plan you are required to be enrolled in both Medicare Part A and B.

Often people work past 65 (or have a spouse who is working) for a company with 20 or more employees that provides them with health insurance without enrolling in Part B. When these benefits are lost due to retirement, death of a spouse, divorce or layoff, signing up for Part B is more complicated if you are past the Initial Enrollment Period. Any of these scenarios are considered a SEP (Special Election Period). In this type of SEP one must fill out a paper application for Medicare Part B, and Section A of the Request for Employment Information form. Your (or your spouse’s) employer must complete Section B of this form. The Request of Employment Information form Section B is needed to confirm you have had credible health insurance coverage during your employment. This is an important part of the process which will prevent you from being penalized for not enrolling in Part B when you first turned 65.

These forms can be found at your nearest Social Security office or going to their website, www.ssa.gov. Once completed they should be mailed or hand carried to the nearest Social Security office. For additional information contact Social Security at 1-800-772-1213.

Mar

2024All Medicare beneficiaries must be enrolled in both Medicare Part A and B before they are allowed to enroll in a Medicare Supplement or Advantage policy. The standard Part B premium amount in 2024 is $174.70. Most people pay the standard Part B premium amount. If your Modified Adjusted Gross Income (MAGI) as reported on your IRS tax return from 2 years ago is above a certain amount, you’ll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium. The chart below shows what you can expect to pay for Medicare Part B.

Find out if you’ll pay a higher Part B premium in 2024:

| As this chart show, your 2022 MAGI determines if your Part B premium will be more than the standard amount: | You pay each month (in 2024) | ||

|---|---|---|---|

| File individual tax return | File joint tax return | File married & separate tax return | |

| $103,000 or less | $206,000 or less | $103,000 or less | $174.70 |

| above $103,000 up to $129,000 | above $206,000 up to $258,000 | Not applicable | $244.60 |

| above $129,000 up to $161,000 | above $258,000 up to $322,000 | Not applicable | $349.40 |

| above $161,000 up to $193,000 | above $322,000 up to $386,000 | Not applicable | $454.20 |

| above $193,000 and less than $500,000 | above $386,000 and less than $750,000 | above $103,000 and less than $397,000 | $559.00 |

| $500,000 or above | $750,000 or above | $397,000 or above | $594.00 |

As this chart shows, if you pay more for Medicare Part B, you will also pay more for your Medicare drug plan:

2024

As this chart shows, if you pay more than the standard amount for Medicare Part B, you will pay more for your drug plan:

| File individual tax return | File joint tax return | File married & separate tax return | You pay each month (in 2024) |

|---|---|---|---|

| $103,000 or less | $206,000 or less | $103,000 or less | your plan premium |

| above $103,000 up to $129,000 | above $206,000 up to $258,000 | not applicable | $12.90 + your plan premium |

| above $129,000 up to $161,000 | above $258,000 up to $322,000 | not applicable | $33.30 + your plan premium |

| above $161,000 up to $193,000 | above $322,000 up to $386,000 | not applicable | $53.80 + your plan premium |

| above $193,000 and less than $500,000 | above $386,000 and less than $750,000 | above $103,000 and less than $397,000 | $74.20 + your plan premium |

| $500,000 or above | $750,000 or above | $397,000 or above | $81.00 + your plan premium |

If you find that your past income will cause you to pay more for both Medicare Part B and your drug plan, but expect your income to be much lower after retirement, you can contact Social Security at 1 800 408 1212 and appeal these additional premiums. Social Security is opened Monday through Friday from 7 AM until 7 PM.

Feb

2024Baby Boomers turning 65 in North Carolina have an abundance of choices with regard to their Medicare insurance. My customers who have been buying their own health insurance and don’t qualify for a government subsidy are thrilled to be able to choose from many policies that are much more affordable. Their challenge is sorting through these numerous policies and choosing what is right for their lifestyle, health needs and pocketbook. If you are uncertain which plan or plans are best for you, here is a step by step guide to ensure you make a wise decision: Read More

Feb

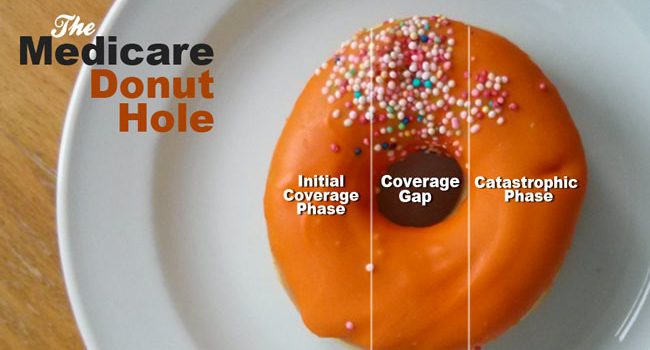

2024If you’re turning 65 or becoming Medicare eligible one of your challenges is choosing a drug plan. Many are confused by the term “Donut Hole” (also called the Coverage Gap). Medicare Prescription Drug Plans have four parts or phases, Initial Deductible, Initial Coverage, Donut Hole and Catastrophic. To understand the Donut Hole it’s important to understand each of these parts.

- The drug plan you choose for 2024 might have no deductible or a deductible as high as $545. Many drug plans have no deductible on the inexpensive generic drugs, but have deductibles on the more expensive brand drugs. This is one way the insurance companies that market these plans control their costs and encourage their members to use generic drugs whenever possible.

- After the initial deductible (if there is one) is met you enter the Initial Coverage Phase. During this period you only pay a copay or a percentage of your prescription drugs. If you purchase a drug with a retail value of $100, but pay $30, the entire $100 counts toward your Initial Coverage Limit. When the retail amount you are paying for all your drugs reaches $5,030(your Initial Coverage Limit for 2024) you have entered the Donut Hole Phase. Another way to say this is when what both you and your Part D Insurance Plan are paying for your drugs reaches $5,030 you’re in the Donut Hole.

- While in the Donut Hole you will pay 25% for your brand-name drugs and generic drugs. When the total amount that you and your Part D Insurance plan reaches $8,000 you will exit the Donut Hole and enter the Catastrophic Phase.

- During the Catastrophic Phase you will pay nothing for your prescription drugs for the rest of the plan year.

Apr

2022If you have recently moved to the Raleigh Durham area and need assistance finding a Duke primary care or specialist doctor, the Duke Consultation and Referral Center can help. They are open Monday through Friday from 8:00 AM until 5 PM. Whether you or not they are Medicare eligible, my clients have found this number helpful. The Duke Referral Center has also help my customers whose doctors have retired or move to a new area find a new doctor.

Call 1-888-ASK-Duke (275-3853) to request an appointment or visit them on-line at dukehealth.org.

Jul

2018Unless someone turning 65 has lifetime health benefits from their or their spouse’s employment, they usually have two choices on how to receive their Medicare coverage. They can enroll in a Medicare Supplement and a separate prescription drug plan or in a Medicare Advantage Plan with drug coverage. If they have drug coverage from previous employment or military service, they also have the option to enroll in only a Medicare Supplement or a Medicare Advantage with no drug coverage.

Typically the premiums for a Medicare Advantage Plan are much lower than a Medicare Supplement. In the Research Triangle area (Raleigh, Durham and Chapel Hill) there are numerous Medicare Advantage Plans that have a zero premium. My experience is that the majority of seniors who sign up for these plans are very satisfied with the benefits and coverage. However, as we all know, life is unpredictable. When your health suddenly takes a turn for the worse having a plan that requires you stay in a network of medical providers or allows you to go out of network, but at a substantially higher cost, can create anxiety. This is why understanding the rules for change are important.

When you first turn 65 you have what is called a “trial right”. This term means you can try Medicare Advantage for one year. At any point during this 12 month period you can drop your Medicare Advantage Plan and return to Original Medicare. Once you drop your Medicare Advantage plan, you have 63 days to enroll in a Medicare Supplement without going through medical underwriting (answering health questions). If you wait longer the insurance companies that market Medicare Supplements will require medical underwriting and can decline you for coverage. You also have 63 days to enroll in a drug plan. If you don’t enroll during the 63 day period you will be required to wait until Annual Enrollment (October 15 through December 7th). The plan you enroll in during this period will not begin until January 1st of the following year. Unless you have a very low income, this will cause you to pay a penalty for going without creditable drug coverage for several months. This penalty will continue as long as you are enrolled in a prescription drug plan.

For folks that are already on a Medicare Supplement there is also a “trial right”. This allows them to drop their Medicare Supplement and try a Medicare Advantage for one year. However, their “trial right” is more restrictive. They can enroll in Medicare Supplement Plans A,B,C,F,K or L without medical underwriting, but the not the popular Plan G.

In 2019 during the Open Enrollment Period, which is from January 1 through March 31, one can change from a Medicare Advantage to a Medicare Supplement and a drug plan. However, unless they are in their first year of Medicare or are enrolled in a plan which is ending, they will be required to go through medical underwriting to obtain a Medicare Supplement.

Sometimes an insurance company will decide to terminate one of their Medicare Advantage plans. This is called a SAR (Service Area Reduction). When this happens they are required to send a letter to each person on this plan. In addition to explaining when the plan will end, the insurance company must provide details on the time period for obtaining new coverage and one’s options during this period. Instead of choosing another Medicare Advantage plan, the policy holders of the terminated plan can choose a Medicare Supplement. This letter is their proof that they are in a “guaranteed issue period”, which allows them to enroll in Medicare Supplement Plans A, B, C, F,K or L without going through medical underwriting.

There are also situations where CMS (Centers for Medicare & Medicaid Services) forces a Medicare Advantage Plan to terminate for not adhering to government rules. This type of termination gives the policy holders the same “guaranteed issue rights” described above.